TL;DR: In August 2022, President Biden announced a plan that would forgive the student loan debt of over 40 million Americans – meaning they wouldn’t ever have to pay it back. Republicans have challenged the plan in court, saying the President doesn’t have the authority to do this. Critics have called it an unfair handout that favors those who took out loans over those who didn’t. The case is currently before the Supreme Court, and we likely won’t know their ruling until late June.

STUDENT LOAN BASICS

Student loans are money given to students to cover the cost of college, either in full or in part, with the expectation that this money will be paid back in the future, plus interest.

-

The overwhelming majority of student loans are given out by the federal government. The government first started issuing loans to veterans after World War II, and has gradually expanded who can borrow money and for what.

-

Since the early 2000’s student loan debt has exploded. In 2000, student loan debt totaled $292 billion; in 2020, it totaled $1.7 trillion.

-

That’s because college is EXPENSIVE. The average cost of college in the United States is $35,551 per student per year, including books, supplies, and daily living expenses.

-

According to the White House, 45 million Americans – or nearly 14% of the total population – have at least some student loan debt.

-

But… one third of all student loan borrowers don’t have a college degree, likely pushed out of higher education by the rising cost of attendance.

PRESIDENT BIDEN’S PLAN

In 2020, a growing movement from liberals and progressives pushed then-candidate Joe Biden to make a campaign promise of forgiving student debt.

-

In August, Biden rolled out a plan that would forgive borrowers of $10,000 worth of debt for people making less than $125,000 a year—or forgive $20,000 of debt if they received a Pell Grant (grants given to low-income families for college).

-

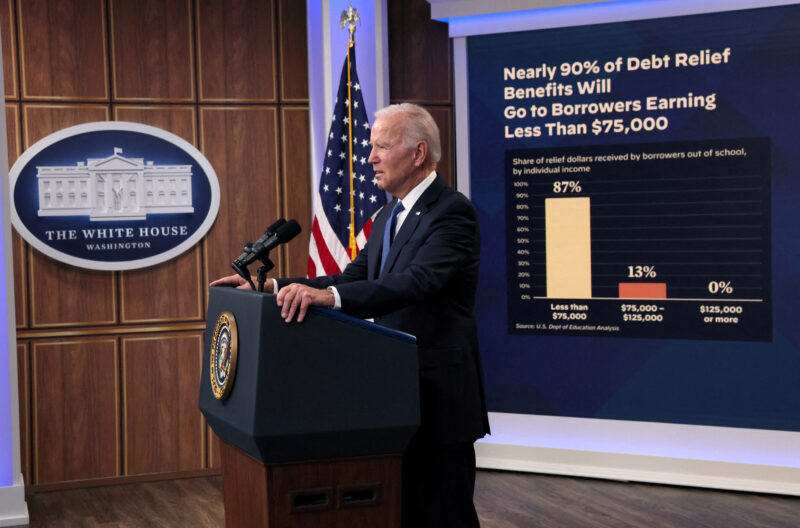

The White House says no high income earners—the top 5%—would receive any student loan relief. They stress this is for middle and low-income families and workers.

-

Under Biden’s plan, the White House says 90% of loan relief would go to workers making under $75,000 a year.

-

The White House also says this would eliminate all student loan debt for 20 million Americans.

THE ARGUMENT AGAINST

Biden’s plan has been opposed by conservatives for three main reasons: (1) it’s an overreach of Presidential authority, (2) it’s a handout to those who took out loans, and (3) its cost.

-

The President has argued he has the authority to take this action under a 2003 law called the HEROES act, which gives the president power to “waive or modify” student loans in a national emergency—in this case the COVID-19 pandemic. Republicans argue it’s an executive overreach, and only Congress has that authority. A case arguing this is currently at the Supreme Court.

-

Conservatives also say it’s an unfair handout to those who took out loans over those who chose not to take out loans in the name of fiscal responsibility.

-

And Republicans object to the cost: The Congressional Budget office estimates it will cost the government $400 billion, which will be added to the national debt.

-

Democrats counter that corporations and wealthy Americans get billions of dollars in handouts every year, while this would favor working-class families.

WHAT HAPPENS NEXT?

On Tuesday, February 28, the Supreme Court heard arguments in the case brought by Republicans challenging the president’s authority to forgive student loan debt. While the case is being deliberated, the plan is on hold. We won’t know what the court decides until the end of its term, usually in late June.

FURTHER READING/SOURCES

-

FACT SHEET: President Biden Announces Student Loan Relief for Borrowers Who Need It Most (The White House)

-

“The Biden-Harris Administration’s Student Debt Relief Plan Explained” (The U.S. Department of Education)

-

Average Cost of College & Tuition Fact Sheet from the Education Data Initiative

-

Total Student Loan Debt Fact Sheet from the Education Data Initiative

-

Federal student loans: What are they & how to apply (Sallie Mae, a student loan lender)

-

Deep dive on the current case before the U.S. Supreme Court from SCOTUS Blog